In-House Accounting vs Outsourcing: Which Is Right for Your Business?

- Home

- Outsourcing for Accountancy Firm

- In-House Accounting vs Outsourcing: Which Is Right for Your Business?

Introduction: Why Choosing the Right Accounting Approach Matters

Running a business is full of decisions, but some choices stick with you longer than others. Picking between in-house accounting vs outsourcing is one of those choices. It is not just about who is handling your invoices or payroll. It is about finding a way to keep your finances in check without letting them take over your day. Some business owners like having an in-house accounting team. It feels comforting to know your accountant is just a few steps away if you need to ask a quick question. Others, though, feel weighed down by managing staff and would rather hand off the numbers to experts through outsourcing accounting services so they can focus on serving customers and growing their business. The choice between outsourcing vs in house accounting can shape the way you handle your cash flow and prepare for taxes, but it also impacts your peace of mind. This guide is here to walk you through the pros and cons of each option in plain language. Because at the end of the day, you want your energy spent on building your business, not stressing over spreadsheets.

What Is the Difference Between Outsourcing and In-House Accounting?

If you are running a business, you have had those days when you are in the middle of helping a customer, and a thought pops up: Did that payment clear? Is payroll sorted for Friday? It is normal, but these little interruptions add up. That is why it helps to know what sets up outsourcing accounting services apart from having an in-house accounting team. When your accounting is in-house, you have someone right there, part of your everyday work. You can pop by their desk, ask for an invoice, or get a quick update. It is straightforward, and it feels close. Many business owners like that hands-on approach. Now, outsourcing accounting services is a different kind of help. You are letting a team outside your office handle your books, track expenses, and prepare your reports. They are not there in person, but they are focused on keeping your numbers organized, and you do not have to think about training or managing one more person. Choosing outsourcing vs in-house accounting really comes down to what you want your day to look like. It is not just about who sends out invoices or checks numbers. It is about finding a setup that helps you stay on top of your business without pulling you away from customers or plans you have been working hard to build.

Understanding Key Differences

| Feature | In-House Accounting Team | Outsourcing Accounting Services |

| Location | Onsite | Remote/External |

| Direct Control | High | Moderate |

| Cost Structure | Salaries + Overheads | Service Fees Only |

| Expertise Levels | Varies by hire | Access to specialists |

| Scalability | Limited, needs new hires | Easy to scale up or down |

| Tools and Software | Provided internally | Included in service |

Advantages of In-House Accounting for Small Businesses

Having an in-house accounting team is like having a safety net right in your office. Let us say you are about to buy more stock or thinking about taking on a big order, and you are unsure if you should. Instead of waiting for an email, you just need to ask. You get your answer, and you keep going. It saves you time. You don’t need to pause your day waiting for someone to send over numbers. You can decide and move forward while the momentum is there. Your team sees your business in real time. They know when you are swamped, and they see the slow days too. They don’t just look at figures. They get what’s going on, and that helps give you updates that fit what is happening. It is also easier to talk through issues when you see each other every day. If something is off, you can sit down and figure it out without back-and-forth emails or waiting on calls. Having your accounting handled in-house is not only about bills and reports. It is about having people you trust to help you keep your business steady while you focus on looking after your customers.

Advantages of Outsourcing Accounting Services

Running a business involves many responsibilities, and outsourcing accounting services can help you manage some of them. You do not have to bring in someone new, set up a desk, or train them. You just hand over the books and let the team handle it. One of the best parts? You get your time back. Instead of sitting late with receipts or trying to fix spreadsheets, you can focus on your customers, your team, or just getting some rest. The people you hire will sort out the numbers, so you do not have to. They also know what they are doing. They are not guessing tax rules or deadlines. They have done this before and can spot errors you might not see, especially when you are tired or in a rush. It is also easy to adjust to. If work picks up, you do not have to go through interviews to find help. If things slow down, you are not stuck with extra payroll. You can add or cut back on services as your business needs to change. At the end of the day, outsourcing is about clearing your head and your schedule. You are still in control, but you are not buried in the paperwork, letting you put your energy where it counts.

Cost of In-House Accounting vs Outsourcing

Money’s tight when you are running a business and figuring out what is worth spending on can feel like a puzzle. When you think about the cost of in-house accounting vs outsourcing, it helps to look at what you are really getting and what it is costing you in time and energy too. With an in-house team, you pay salaries. You have also got taxes, benefits, even extra equipment, or software to keep things moving. It is steady, and you get your team right there when you need them, but the costs add fast, especially if your business is still finding its footing. Outsourcing can look cheaper at first because you are paying for a service instead of a full-time salary. You do not have to handle health insurance or sick days, and you are not buying extra desks or computers. You pay for what you need, and that can be a lifesaver when you are looking at your budget closely. But it is not just about dollars. It is about what gives you peace of mind too. In-house teams can jump on a problem fast, while outsourcing means waiting for a reply sometimes. On the other hand, outsourcing means you are not up at midnight sorting receipts. When you look at the cost of in-house accounting vs outsourcing, it is not always about which is cheaper. It’s about which setup helps you run your business without losing sleep and keeps your numbers clean while you focus on growing.

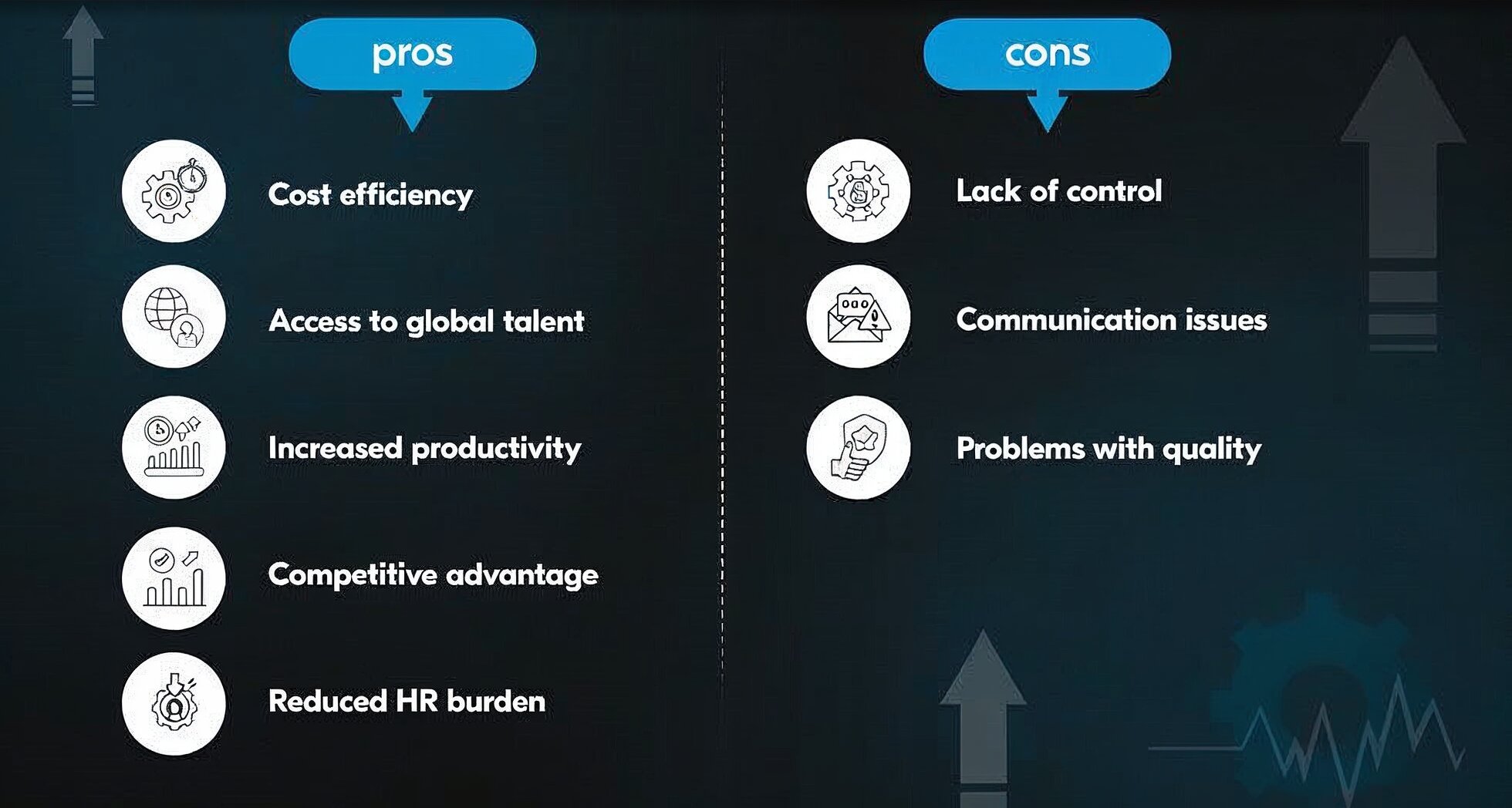

Pros and Cons of Outsourcing Accounting vs In-House Accounting

Choosing how to handle your books can feel like a big call. Do you keep it close, or hand it off? Each way has its difficulties, and what fits your Neighbour’s shop might not fit yours. When you have got folks in-house, it is easy to get answers. Are you about to place a big order? Just ask. Do you need to check cash before hiring someone? They can pull the numbers fast. Your team knows your busy weeks and the slow ones. They get your business done. But it costs. You are paying wages, benefits, and covering for holidays.

Now, outsourcing accounting vs in-house accounting is a different game. You do not have to train anyone or worry about cover when someone is off sick. You pay for a service, and they handle the books. They know tax rules, and you get your reports. It is often easier if your work picks up or drops off. But you might not get an instant answer, and you are not chatting face-to-face. Looking at the pros and cons of outsourcing accounting vs in-house accounting is about figuring out what keeps you steady. It is what helps you sleep at night while your business keeps moving.

How to Choose Between In-House and Outsourced Accounting

So, how do you decide which way to go? It is not always clear. Picking between in-house and outsourced accounting comes down to what you need and how you like to work. Think about your day. Do you want someone there, in person, ready when you need numbers fast? An in-house setup might fit. You get quick updates, and your team sees how your business runs. They know your customers, your busy days, and the way you like things done.

But if you are tired of managing one more thing, outsourced accounting could be a better fit. You will not have to train anyone or worry about covering sick days. You get experts handling your books, and you can adjust what you need as your business changes. Also, look at your budget. In-house means paying wages and benefits. It can cost more, but it is close and direct. Outsourcing can save money, and you pay only for the services you need. But you might need to wait for answers sometimes. Choosing between in-house and outsourced accounting is about keeping your books clean while letting you focus on customers and the work you care about.

Choosing the Right Accounting Service Provider

You can relieve some of your stress by finding the right people to manage your books. You need reliable individuals, whether you choose to hire someone in-house or outsource. First, find out if they have experience working with companies like yours. When they understand your industry and the types of issues you face daily, it helps. You want someone who can anticipate issues and address them before they become more serious headaches. Ask what tools they use. Good accounting these days is not about punching numbers into a calculator. It is about using the right software to keep your records clear and easy to pull up when you need them. If you are outsourcing, ask how they keep your info safe. Remember the way they speak to you. You do not want someone to leave you baffled by technical terms you do not understand. To avoid guesswork when making decisions, you need updates in plain language so you can act with confidence. Think about flexibility, too. Your business might get busy, or you might hit a slow patch. A solid accounting service will roll with your changes, so you are not stuck paying for stuff you do not need. At the end of the day, choosing the right accounting service is about trust. It is about clear talks, fair costs, and having people who help you keep your numbers straight while you keep your business moving.

How Eco Outsourcing Can Help Your Business

If you run a business, you already know how messy things can get. Orders coming in, customers calling, staff asking questions. Then there is the money side, keeping track of payments, receipts, and taxes. It is a lot, and it can pull you away from the parts of your business you enjoy. That is where Eco Outsourcing comes in. We handle your bookkeeping and accounting, so you do not have to lose sleep over numbers or spend your weekends sorting receipts. You will not have to worry about missing a payment or scrambling when tax season rolls around. We keep your books up to date, so you always know where things are. We also know that no two businesses are the same. Some months are busy, others not so much. We work with you to adjust as you go, so you are only paying for what you need. No extra fluff, just what helps you stay on top of things. At the end of the day, it is about letting you get back to your customers, your team, and the work you care about. We will take care of the numbers so you can focus on growing your business without the stress of handling it all alone. With Eco Outsourcing, you have a team in your corner, making sure your finances stay clean while you keep your business moving.

Conclusion: Deciding Between In-House and Outsourced Accounting

Managing your books is an essential part of running your company. Some people want their accountant nearby, so they can quickly look up numbers or provide an immediate response to a query. Others find it easier to delegate so they can continue to concentrate on their clients’ and revenue-generating tasks. Both paths can work. An in-house setup gives you quick answers and a clear view of your cash flow. Outsourcing takes it off your plate, so you are not sorting receipts at night or stressing over tax deadlines. It is about what feels right for you. What keeps your day moving without extra stress? What does your budget fit? What helps you sleep at night knowing your numbers are handled? In the end, clean books help you run your business without getting stuck in paperwork, letting you keep moving toward your goals.

FAQs

Outsourcing means you pay someone outside your business to handle your numbers. They track what you earn and what you spend, and they sort out your reports, so you do not have to. In-house is different. You have gotten someone on your team, in your space, dealing with bills, payments, and money stuff as it happens. You can ask them questions right away and get answers fast. Outsourcing saves you time if you are busy, while in-house keeping things close. It is about what feels easier for you while keeping your business running without extra stress.

Outsourcing usually ends up costing less since you are only paying for the help you need, not a full-time wage and benefits. You pay a set fee, and that covers your books and reports. With in-house, you are paying someone’s salary every week, covering sick days, and paying for software too. It can add up, but you get someone there when you need a quick answer. It really depends on what you can handle in your budget and what makes your life easier while you keep serving your customers and staying on top of your business.

Outsourcing can take work off your plate, but there are a few things to keep in mind. Sometimes, you might wait a bit for updates since they have other clients too. You are giving them your business info, so you need to trust that it stays safe. Mistakes can happen if something gets missed or if you are not checking in now and then. Best thing you can do? Pick a team that talks to you clearly, protects your info, and is easy to reach. The right folks will help you, not give you more to worry about.

Seek out a person who has assisted companies similar to yours. Find out what tools they use and how they protect your information. Make sure they use simple language, not confusing terms. See if they pick up the phone or reply when you need them. Check reviews or ask people you trust who they use. The right provider should help you stay on top of your money without making life harder. They should let you focus on customers while they handle the books. It is about trust and keeping your business steady.

Recent News

Why Outsourcing Is the Key to

6th November 2025

Why Business Process Outsourcing is the

14th August 2025